For B2B marketing, discovery used to feel more contained. Buyers searched, compared a short list of options, and moved forward with a clearer sense of next steps. Today, discovery is harder to trace because it unfolds over time and across environments. McKinsey’s research tells us buyers engage with an average of 10 distinct channels during their journey.

Understanding doesn’t arrive all at once. It accumulates gradually, shaped by repeated exposure, comparison, and validation, often without a clear signal of when confidence is finally earned.

Here on TopRank Marketing’s B2B Marketing Blog, we’ve explored how multi-channel discovery is designed into the Best Answer Marketing framework, along how insight clarifies what buyers are trying to solve, how integration keeps ideas coherent, how trust supports belief, and how experience deepens engagement.

This is where narratives must hold together. Discovery is no longer about first impressions alone. It’s about whether the same thinking survives comparison as buyers encounter it repeatedly, in public spaces, through different voices, and under different forms of scrutiny.

Why discovery no longer follows a single path

Buyers no longer move neatly through a fictitious funnel from awareness to consideration to decision. Discovery now unfolds across multiple environments, often without a clear starting point. Each environment plays a different role, and none carries the full weight of the decision on its own.

AI-driven tools often provide early orientation, helping buyers frame a problem quickly. Search engines support validation, allowing buyers to check claims and compare perspectives. Peer-driven spaces introduce lived experience, while expert voices and brand content help buyers evaluate whether an idea holds up in practice. These interactions don’t replace one another. They accumulate.

What’s changed isn’t buyer intent. Buyers are still trying to make sound decisions. What’s changed is how they reduce uncertainty. Instead of trusting a single source, buyers increasingly compare signals across surfaces, looking for consistency before they commit.

In this environment, visibility alone is insufficient. If ideas shift, contradict themselves, or lose clarity as buyers move between channels, confidence erodes. Multi-channel discovery becomes less about reach and more about continuity: ensuring the same core thinking remains intact wherever buyers look for reassurance.

What research reveals about multi-channel discovery

Our research in The State of B2B Thought Leadership in 2026 reflects this shift. Discovery no longer happens in one place, and many marketing teams feel the strain of trying to support buyer evaluation across multiple environments at once.

The 797 senior B2B marketers that responded to the survey consistently point to fragmentation as a challenge. One-third cite limited visibility into how efforts perform across the funnel, while another third report over-reliance on a small number of channels. These signals suggest that while marketers recognize buyers are encountering ideas in more places, many lack the structure to support those encounters in a connected way.

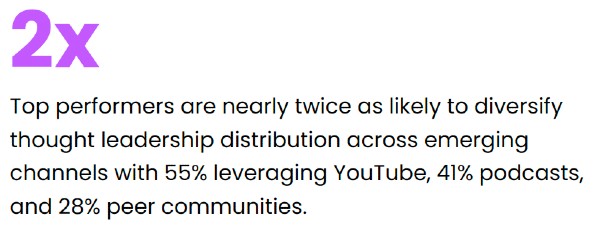

At the same time, influence is becoming more distributed. Top-performing teams are nearly twice as likely to diversify thought leadership distribution across emerging channels, extending their presence beyond a narrow set of platforms. This includes greater use of video, podcasts, and peer communities, environments where buyers can revisit ideas, interpret nuance, and validate perspectives over time.

Source: The State of B2B Thought Leadership in 2026 – TopRank, Ascend2

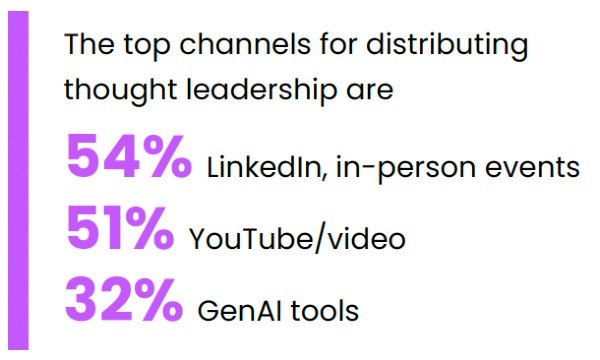

The report also highlights a growing disconnect between how B2B marketers distribute thought leadership and how buyers actually discover it. While LinkedIn and in-person events remain core channels, video plays an increasingly important role, and nearly one-third of buyers now report using GenAI tools to discover thought leadership, a channel many marketers still treat as secondary.

Source: The State of B2B Thought Leadership in 2026 – TopRank, Ascend2

Taken together, these findings point to an important challenge. The issue isn’t selecting the right channel. It’s making sure that the same underlying thinking shows up consistently wherever buyers go to validate, compare, and build confidence in their decisions.

How buyers use different channels to reduce uncertainty

As discovery stretches across more environments, B2B buyers begin to rely on each channel for a specific type of reassurance. The value of each touchpoint becomes clearer when viewed through the lens of risk reduction rather than message delivery alone.

- AI-driven tools often help buyers orient themselves quickly. These systems summarize, synthesize, and surface options, offering a starting point rather than a final answer.

- Search engines tend to play a validating role. Buyers use them to compare approaches, check claims, and look for corroboration across multiple sources.

- Peer-driven spaces introduce lived experience. Forums, reviews, and community discussions help buyers understand how ideas perform under real-world conditions.

- Influencer perspectives, analysts, and brand-owned content often come into focus later. At this stage, credibility matters less as a label and more as something demonstrated through consistency, evidence, and clarity.

What matters most is not the sequence of these interactions, which can vary widely, but the function they serve. Buyers are building up confidence incrementally. Each channel answers a different question, and together they determine whether an idea feels reliable enough to act on.

How high-performing B2B brands design for multi-channel discovery

High-performing B2B marketers accept that they do not control where discovery happens. Buyers encounter ideas in different places, at different times, often outside of any campaign structure. The responsibility, then, is not so much about channel dominance but building consensus around the brand narrative. It’s about being the best answer in a meaningful way, where buyers are looking, where they trust and where they are influenced.

Rather than planning channels independently, top performing B2B marketers start with a clearly defined point of view and make sure it holds up with proof and credibility wherever buyers are likely to look for confirmation. Language, proof, and framing remain aligned whether the idea appears in an AI-generated summary, a search result, a peer discussion, or a deeper piece of owned content. This continuity of narrative that uses proof to build consensus is central to the Best Answer Marketing system and also aligns well with LinkedIn’s ideas around Buyability.

These results focused B2B marketers also recognize that repetition is not wasteful. Buyers expect to encounter the same ideas more than once. When designed intentionally, each exposure adds context, reinforces understanding, and reduces the cognitive effort required to trust what they’re seeing.

Most importantly, high-performing marketers plan discovery around actual buyer behavior. They assume buyers will compare sources, seek external validation, and revisit ideas as decisions evolve. Structuring information and discovery with this behavior in mind is as good for helping LLMs choose your solution as it is for humans. The goal is not to force a linear path, but to make each point of evaluation easier to navigate by keeping the underlying thinking consistent.

Multi-channel discovery rewards consensus

Multi-channel discovery doesn’t require brands to be everywhere. It requires them to be consistently reliable wherever buyers happen to look.

As discovery increases across AI tools, search engines, communities, and owned media, advantage shifts away from channel mastery and toward narrative coherence. Buyers don’t build decision confidence from isolated touchpoints. They build it when ideas remain steady under comparison, when proof doesn’t change by channel, and when guidance builds and feels cumulative.

In that sense, the hidden job of multi-channel discovery goes beyond reach. It’s to build confidence. B2B companies that understand this move beyond simply being seen and toward being believed as Best Answer Brands.

To better understand the opportunities to use proof to build consensus and become a Best Answer Brand, download the report PDF: Answer Engine: The State of B2B Thought Leadership in 2026 to see how top B2B marketers are designing for multi-channel discovery and building consensus wherever buyers look.